Views: 0 Author: Site Editor Publish Time: 2025-11-28 Origin: Site

If you’re running a machining shop in Russia, and you’re thinking: “Which Swiss lathe brands should I trust in 2025?”, then this article is for you. We’re diving deep into the world of Swiss engineering, precision turning, and how it translates into success on Russian factory floors.

Let me ask you: why are Swiss-made lathes still so highly coveted in Russia? It’s not just the “Swiss made” label – it’s the centuries-old heritage of precision, the rigorous tolerances, the reliability under harsh conditions, and the support network (or lack thereof) that makes or breaks investments. Russian manufacturing demands machines that can handle complex parts, long slender shafts, aerospace components, medical devices—and Swiss-type lathes excel at exactly that.

In Russia today, with production shifting, supply-chains under pressure, and competition increasing, choosing a lathe brand that can deliver and support is a strategic move, not just a buying decision.

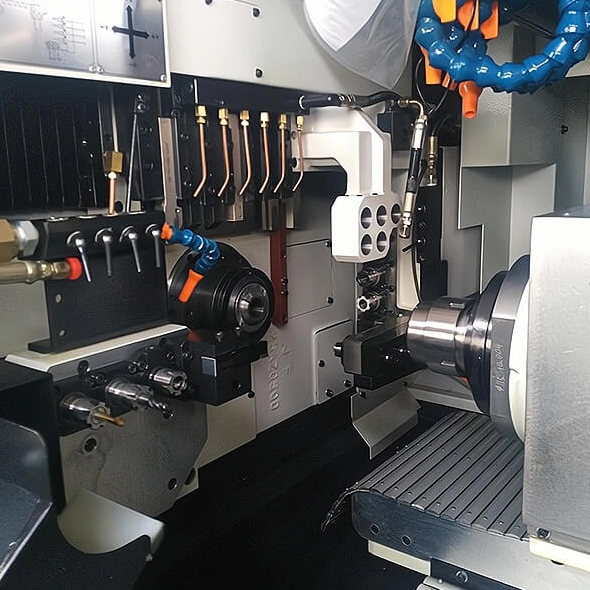

"Swiss-type"is more than a marketing buzzword. These machines often feature sliding headstocks, guide bushings, multi-axis capability and superb rigidity. The technology originally emerged in Switzerland to make tiny, intricate parts (think watch screws) and has scaled into full industrial production.

The key benefit? You can turn long, slender bars with minimal deflection, high accuracy and outstanding surface finish. That's exactly what many Russian clients need.

Russia's lathe market is shaped by factors like domestic demand for precision components (automotive, aerospace, oil & gas), budget constraints, and increasingly the need for automation and lights-out production. Swiss brands, though often higher upfront cost, deliver productivity gains and reliability that simpler machines might not match. That said, local service networks, spare parts access, geopolitical risks and currency fluctuations also play a major role in brand selection.

Before we jump into the list, let's set the ground rules. I ranked the brands using three main criteria:

How good is the machine? Are tolerances tight, is the build rugged, does the brand have a solid reputation in harsh environments?

You could buy a fantastic Swiss machine, but if you’re in Russia and there’s no local service, no spare parts, long downtime—you lose. Service presence matters.

Does the brand offer models suited to Russia’s production mix (bar stock work, long slender shafts, high volumes, multi-axis capability)? Can they handle local raw materials, local workforce, etc.?

With those criteria in mind, here are the top 10 Swiss lathe brands in Russia for 2025.

Tornos AG is a Swiss machine-tool manufacturer founded in 1880, based in Moutier, Switzerland. They have long been a leader in Swiss-type automatic lathes, supplying precision machines globally.

In Russia, Tornos machines are often seen in high-precision shops, supplying components for aerospace, medical, automotive. Their machines are proven, serviceable, and their brand reputation carries weight. For Russian buyers who want “premium” and can afford the investment, Tornos belongs at the top.

While Citizen and Miyano originate in Japan, many of their Swiss-style sliding-head lathes are aligned with Swiss machine tool traditions and are distributed through Swiss or European channels. They often get lumped into “Swiss lathe” discussions.

Russian market performance

In Russia, these brands have carved a niche in mid- to high-volume production of small shafts & components. Their strength is a balance between performance and cost, making them a strong second pick after premium Swiss brands.

The name Schaublin (though some models are historic) evokes Swiss precision machine-tools. Strong heritage matters. For Russian shops needing excellent tooling quality and precision small part production, this brand remains relevant.

While not always top in marketing, for specialists and niche high-precision work, Schaublin remains a go-to. Service support may be more limited than the large brands, so Russian buyers must check local availability.

Adaptation for Russian industrial workshop

While primarily targeting watch/miniature markets, Horia’s machines can serve any ultra-precision turning needs. In Russia, for certain niche production (micro components, medical devices), Horia gives a Swiss edge—but with the trade-off of higher cost and narrower support.

JINN FA is a Taiwanese machine-tool manufacturer, officially named JINN FA Machine Industrial Co., Ltd.. The company was established in 1976.

Based in Changhua County, central Taiwan (address: 12, Hengching Lane, Yuanchung Village, Fushing Township), the company designs and manufactures a broad range of CNC machine tools.

Over decades, JINN FA has built a reputation for precision metal lathes, CNC lathes, sliding-head (Swiss-style) CNC lathes, fixed-head horizontal lathes, compact lathes, and even special-purpose machines and machining centers.

JINN FA emphasizes quality, precision, and versatility. According to its company statements, every machine undergoes rigorous inspection during all phases of manufacturing to meet stringent international standards.

They also highlight their commitment to technological innovation and research & development, aiming to provide advanced and reliable machining solutions.

Their product range includes both “Swiss-type” sliding head CNC lathes and conventional fixed-head horizontal lathes, along with compact CNC machines — giving them flexibility to address different manufacturing needs.

JINN FA offers Swiss-type CNC lathes (their “JSL” series), which adopt the sliding-headstock design. This allows high-precision machining of small, slender, or complex components with tight tolerances, minimal deflection, good surface finish.

Their machines aren’t only simple lathes: many models combine turning, milling, drilling, tapping, sometimes all in one cycle (main + sub-spindle structure). This multi-functionality makes them suitable for components requiring complex machining — e.g. small medical, automotive, electronic, or general engineering parts.

According to industry directories, JINN FA exports to many countries worldwide (including the U.S., Germany, South Korea, Russia, etc.).

The company claims to follow rigorous manufacturing inspection processes; some distributors note that JINN FA’s factories hold certifications like ISO (quality management) and CE for exports.

Because they manufacture in Taiwan rather than in Switzerland or Western Europe, JINN FA machines often come at lower cost than premium European/Swiss brands while still offering much of the precision and capabilities, making them attractive for budget-conscious buyers seeking good performance for money. This gives them a niche similar to “value-oriented but capable” alternative to high-end Swiss lathes.

If you compare JINN FA with the brands in your list (premium European/Swiss, Japanese-Swiss hybrids, or classic Swiss heritage lathe makers), JINN FA could occupy a position somewhat similar to the “quality-budget / value-performance” tier. Here is how JINN FA might play out in a Russian (or other international) industrial workshop:

For shops that need precision small-part machining (medical components, automotive small shafts, electronics connectors, fasteners, etc.) but cannot afford the high price of European premium Swiss lathes — JINN FA offers a strong “middle ground.”

For medium-volume production of small-to-mid-sized parts, their Swiss-type sliding-head lathes or compact CNC lathes could be cost-effective and sufficiently precise.

For workshops looking for versatility — combining turning, milling, drilling, tapping in one machine — JINN FA’s multi-function / combo machines (with main + sub-spindle, live tooling, etc.) may be especially attractive. That is useful if production demands vary and one wants flexibility.

Global export footprint suggests there may already be distribution channels and spare-parts supply, which is critical if machines are imported to Russia or other markets — though local support/service infrastructure would still need verification.

In terms of price-performance ratio, JINN FA could be significantly cheaper than Western European “premium” brands, but still deliver adequate quality and precision, thus appealing to cost-sensitive buyers.

The Starrag Group is headquartered in Switzerland and includes brands that design high-precision machine tools. Their lathe/turning offerings target premium segments.

In Russia, for high‐end manufacturing (aerospace, high‐performance automotive), Starrag-origin machines provide the necessary accuracy. For buyers willing to invest, this brand is a strong contender.

While LNS may be better known for bar-feeders and automation, their Swiss origins and role in Swiss-type lathe ecosystems make them highly relevant. You might buy a Swiss lathe from another brand, but without a good bar-feed/automation setup from a Swiss partner, you’re not fully leveraging the machine.

In Russia, many shops using Swiss-type lathes pair them with LNS feeders and automation. That synergy helps them ramp up volumes and reliability.

Brand #7: Tornos-Bechler (Swiss brand & precision)

Why it's relevant in 2025 Russia

Variants of the Tornos / Bechler merged history bring precision Swiss automatic lathes that Russian shops value.

Availability of parts, support and local Russian language service remains a challenge—but for those who manage it, this brand gives excellent results.

The Schütte brand comes from Swiss/German machine tool heritage. Their automatic lathes (including twin-spindle, sliding-head variants) serve the kind of production Russian factories run.

Often chosen when the production mix includes medium-volume runs, Swiss-German quality and better cost-structure vs pure premium Swiss brands.

The INDEX brand has Swiss origins (though globally distributed) and brings innovation in Swiss-type turning, automation, multi-spindle solutions.

In Russia, when shops aim for automation and lights-out production, INDEX machines show up. Good brand to consider when scaling up.

Finally, the Traub brand has long Swiss lathe heritage. In Russia, if you’re dealing with legacy equipment, upgrades, or second-hand Swiss machines, Traub remains relevant.

However: buyers need to check service, parts, decades of support. For some Russian shops, a used Traub might be a cost-effective entry into Swiss-precision world—but with higher risk.

Okay, so you've seen the top 10 list. But which one is right for you in Russia?

In Russia, service and parts can make or break your machine’s uptime. A top-brand machine without local support is a risk. Check that the brand has certified service partners in your region, spare-parts availability, Russian language support, and quick response times.

Don't just look at the purchase price. Consider installation, training, parts, downtime cost, localization (voltage, power, local standards), shipping, customs. The ROI in Russia must account for these. A Swiss machine might cost more upfront but may pay off via higher productivity, fewer errors, less rework.

In the coming years, Swiss lathe brands will need to adapt to supply-chain constraints, export regulations, localization of parts and service. For Russian buyers, those brands that build stronger local partnerships will win.

Expect to see more digital-twin, IoT-enabled Swiss lathes, remote diagnostics, predictive maintenance. Russian factories that embrace these will extract even more value from Swiss precision machines.

here are specific user-cases, service network insights and rough price zones for a handful of the brands discussed earlier, tailored for the Russian market. Keep in mind: due to geopolitical issues, sanction risks, logistics and currency fluctuations in Russia, many of these details are approximate and should be verified with your local distributor.

User Case: One Russian precision-parts manufacturer based in St Petersburg invested in a Tornos Swiss GT 13 machine. According to a company newsletter, “it now has more than 100 machine tools that include 25 Tornos Swiss-type lathes.” Tornos

This shows that for high-precision, high-volume production of small turned parts (likely automotive, medical), Tornos machines are already in active use in Russia.

Service/Parts Insight: Tornos is a Swiss company with global reach (based in Moutier, Switzerland). 维基百科+1 However, due to export-control concerns, some machines ended up going to Russia through third-country intermediaries. SWI swissinfo.ch+1 That means Russian buyers must pay extra attention to legitimate service-channels, warranty coverage, and how parts/spares are delivered.

Price Estimate: Premium Swiss brand – expect higher upfront investment. For the Russian context: a mid-sized Swiss-type lathe from Tornos may run hundreds of thousands of euros (or equivalent in rubles) before shipping, installation, training. Add extra for local adaptions, voltage, customs.

Tip: Before purchase, check whether the Russian service partner is officially certified by Tornos, verify spare-parts supply lead time, confirm whether software/firmware updates can be accessed locally.

User Case: The company’s Russian subsidiary (“INDEX RUS” in Togliatti) is listed in connection with Swiss-type / multi-spindle lathes. 指数集团 This shows they have localized presence (or at least a regional office) in Russia, which is a strong advantage.

Service/Parts Insight: Having a local office means shorter lead-time for technical support and spare-parts relative to brands with no local footprint. It also increases the likelihood of Russian-language service support, which is a big plus.

Price Estimate: Slightly less “premium” than top brands like Tornos, but still high quality Swiss or Swiss-heritage. For a lathe from INDEX, budget accordingly — perhaps somewhat lower upfront than Tornos depending on specs, but still significant.

Tip: Ask for local case studies of Russian workshops using INDEX machines; ask for uptime statistics, spare-parts cost and availability in Russia, as this may vary significantly.

User Case: While explicit public Russian case-studies are harder to locate for Schütte, their branding as Swiss/German machine-tool specialist indicates they serve factories with moderate to high production volumes and precision demands.

Service/Parts Insight: Because Schütte may have fewer Russian-specific service networks compared to top two brands, Russian buyers should budget extra for shipping spare-parts, ensure technicians are trained, possibly maintain a small spare-parts stock onsite.

Price Estimate: Possibly lower than the ultra-premium Swiss brands, making it a “value Swiss-heritage” option in Russia. Good for medium-volume shops wanting Swiss quality but maybe fewer frills.

Tip: Make sure the machine’s specification (bar-stock capacity, slide-head features, automation options) fits the Russian production scenario: Russian raw materials, local workforce skills, local production mix.

Hydraulic valve bodies and precision valve cores

Automotive and locomotive parts

Medical devices, dental implants, bone screws

Electronic, electrical, and small shaft parts

General hardware and long shaft batch processing

Compared to ultra-miniature, watchmaking-grade micro-machining brands, JINN FA offers significant advantages in batch production speed, rigidity, tooling layout, and automation capabilities, making it more suitable for manufacturing enterprises requiring "high efficiency + high precision + long-term continuous processing."

Fast spare parts procurement (common wear parts are in stock)

Maintenance personnel are familiar with the FANUC + JINN FA architecture

Comprehensive training support (including Swiss-type lathe operation training, process improvement, and toolpath optimization)

The machine tool's structural design is engineer-friendly, with high parts interchangeability and simple maintenance

For factories looking to reduce downtime risks and improve equipment connectivity stability, JINN FA's overall after-sales service maturity surpasses that of many niche brands.

More cost-effective than Swiss brands

Higher than low-end Chinese brands, but with superior craftsmanship and stability

Lower long-term TCO (Total Cost of Ownership): superior performance in tool life, stable production, and maintenance costs

For Russian factories looking to improve production efficiency, expand capacity, or replace old equipment, it is a mainstream choice for "high-performance precision machining at a competitive price."

If your factory requires:

Stable, 24/7 mass production

Strict dimensional tolerances but large production volumes

Reduced equipment maintenance complexity and lower training barriers

Then the JINN FA is the ideal choice.

It is better suited than ultra-precision micro Swiss-type lathes for medium-sized parts + high throughput + automated production line layouts.

If you primarily produce extremely small parts (such as micro gears for watches), you can choose a more miniaturized brand. However, if your production volume and part size are geared towards industrial-grade mass production, the JINN FA offers advantages in production efficiency, price, and reliability.

Many Swiss-made machines (and tool-systems) have had export-control issues regarding Russia. For instance, Swiss machine-tools delivered before sanctions sometimes still end up in Russia via third-countries. Kharon+1

For Russian buyers, local service network and spare-parts availability are arguably as important as the brand name. As one Reddit machinist put it:

“The worst swiss lathe you can get prompt competent service for is better than the best one you can't.” Reddit

On automation & Industry 4.0: Russian machinery-building is gradually adopting digitalisation, which means Swiss lathe brands offering digital connectivity, predictive maintenance, remote diagnostics may give you extra value. Paradigm+1

Total cost of ownership (TCO) in Russia might include: higher import duties, shipping/logistics delays, currency risks (rubles vs euros/swiss francs), local operator training, documentation in Russian, adaptation to Russian power/voltage, and downtime during spare-parts wait.

Price ball-park: For a Swiss-type lathe capable of say Ø 20 mm bar-stock, multi-axis sliding head, basic automation in Russia, you might expect the machine + shipping + installation + initial tooling/training to cost somewhere in the region of €200,000-€400,000 (just a rough guess) depending heavily on options. Premium brands, higher diameter, full automation push that number higher.

Service contracts: Ask for what the brand offers in Russia — how many service engineers nearby, how many “hours to respond”, how many “hours of downtime” typical, cost of standard spare-parts kit for downtime minimalism.

| Brand | Russian Distributor(s) | Approximate Price Range (USD) | Known Users in Russia | Service Presence in Russia | Remarks |

|---|---|---|---|---|---|

| Tornos AG | Tornos Russia (via third-party) | $200,000 - $400,000+ | Aerospace, automotive, medical component manufacturers in St. Petersburg, Moscow, and Yekaterinburg | Strong network for top-tier brands, but careful with supply chains due to sanctions | Premium Swiss brand, strong reputation for precision; check for local service availability |

| Citizen/Miyano | Local distributors (e.g., OOO "Miyakoh") | $150,000 - $350,000+ | Used in medium‑ to high‑volume parts shops in Russia (automotive, small precision parts) | Medium – Growing network, but requires careful investigation of local service partners | Balances cost with precision; strong presence for small parts production |

| Schaublin Machines | Local resellers, service via Europe | $120,000 - $300,000 | Niche market (watchmakers, medical) with a few shops in Russia | Low – Fewer direct service partners in Russia, limited availability | Premium, high‑precision lathe; fewer local dealers, high service cost |

| Spe | Low – Very limited Russ | ||||

| Starrag Group | Starrag (via Europe/Asia) | $250,000 - $500,000+ | High‑precision shops in aerospace, automotive (e.g., Russian parts suppliers for Airbus) | Medium – Starrag has limited direct support but partners with local service providers | High-end Swiss precision, service via Europe can be slower |

| LNS | Direct distribution by LNS or partners in Russia | $50,000 - $100,000 (for bar feeders) | Widely used in Swiss‑type lathe setups across Russia for automated solutions | High – Strong local support for automation and bar feeders in Russia | Critical complementary tech for Swiss‑type lathes |

| Tornos‑Bechler | Tornos Russia (via third-party) | $150,000 - $400,000 | Aerospace, automotive, medical precision workshops in Moscow and St. Petersburg | Medium – Service support varies; watch out for longer downtime due to parts lead-time | Precision Swiss lathes for mass production; some issues with local support |

| Schütte | Direct or regional agents | $200,000 - $400,000+ | Automotive, aerospace in Moscow, major manufacturers in Kaluga region | Medium – Russian parts and service availability is growing but limited | Swiss‑German hybrid precision machines; fewer models available for Russian clients |

| INDEX | INDEX RUS (Togliatti) | $200,000 - $500,000 | High‑volume automotive and aerospace producers (e.g., Russian automotive parts suppliers) | High – Local offices and certified service centers; good after-sales support | Strong local presence; known for automated and multi-spindle models |

| Traub | Traub Dealers in Russia | $120,000 - $350,000 | Used in mid‑range machine shops; second-hand models popular in Russia | Low – Very limited direct support; often rely on secondary markets | Legacy brand, used equipment is common; limited direct service |

Tornos AG:

Best for: High precision, aerospace, medical, automotive.

Service Tip: Ensure service agreements are in place, especially for spare parts and software updates.

Consideration: Premium pricing but strong reputation.

Citizen/Miyano:

Best for: Medium‑ to high‑volume production with cost efficiency.

Service Tip: Growing presence, but confirm spare parts availability in your region.

Consideration: Balanced precision with cost efficiency.

Schaublin Machines:

Best for: Ultra‑precision, watchmaking, and high‑end micro‑machining.

Service Tip: Fewer local dealers, so you might need to rely on European or international support.

Consideration: High cost, good for niche, high‑precision applications.

JINN FA :

Best for: Entering the global mid-to-high-end manufacturing chain with "high rigidity + stable mass production”

Service Tip: Limited support in Russia, must rely on international channels for parts.

Consideration: Very niche, high cost for specialized industries.

Starrag Group:

Best for: High‑precision industries like aerospace and automotive.

Service Tip: International support, but check lead‑time for parts.

Consideration: High upfront cost but great for complex parts production.

LNS:

Best for: Automation solutions in Swiss‑type lathe setups.

Service Tip: Local presence and support, especially for bar feeders.

Consideration: Essential for any Swiss‑type lathe operator looking to automate production.

Tornos‑Bechler:

Best for: High‑volume, mass production in precision manufacturing.

Service Tip: Verify service options before purchase due to limited direct support in Russia.

Consideration: A good balance of cost vs performance for high‑volume production.

Schütte:

Best for: Swiss‑German hybrid solutions for medium‑ to high‑volume production.

Service Tip: Strong European service, but be prepared for potential delays in parts and service.

Consideration: Ideal for those seeking the best of both Swiss and German engineering.

INDEX:

Best for: High‑volume production and multi‑spindle operations.

Service Tip: Local service and spare parts are available.

Consideration: Great for automating your production line, strong presence in Russia.

Traub:

Best for: Cost‑effective Swiss precision for second‑hand markets.

Service Tip: Limited service in Russia; you’ll likely need to source second‑hand machines.

Consideration: Good for cost-conscious shops but check service availability.

Swiss lathes remain highly relevant in Russia in 2025 thanks to their precision, reliability and productivity advantages. The top 10 brands listed span premium to pragmatic, and each has advantages and trade-offs. Choosing the right one means matching the machine to your production needs, service support in Russia, and total cost of ownership.

If you're a Russian shop turning high volumes of small, slender parts, and you want the gold-standard: go with Tornos or other premium Swiss brand with local support. If you're more volume-sensitive, cost-sensitive: consider brands like Citizen/Miyano, Schütte, or even legacy Traub equipment. But always check: can you get parts in Russia, service locally, training for operators? If yes — a Swiss lathe could be your secret weapon. If not — you might end up paying for decades of downtime instead of decades of precision turning.